I still remember the day I decided to take control of my finances and start investing – it was like a weight had been lifted off my shoulders. I had always thought that investing was only for the wealthy or those with a background in finance, but as I delved deeper, I realized that this was just a common myth. In reality, a guide to starting to invest is not as complicated as it seems, and with the right approach, anyone can begin building their financial future. I’ve seen many friends and family members struggle to get started, overwhelmed by the numerous options and technical jargon, but I believe that with a clear and structured plan, anyone can overcome these hurdles.

As we work through this guide together, I promise to provide you with practical and actionable advice that will help you navigate the world of investing with confidence. We’ll break down the process into simple, manageable steps, and I’ll share my own experiences and insights to help you avoid common pitfalls. By the end of this article, you’ll have a clear understanding of how to get started with investing and be well on your way to achieving your financial goals. Whether you’re looking to save for a big purchase, retire comfortably, or simply build wealth over time, this guide will provide you with the foundation you need to succeed. So, let’s get started on this journey together and turn your investment dreams into a reality, one step at a time.

Table of Contents

Guide Overview: What You'll Need

Total Time: 1 hour to several days

Estimated Cost: $0 – $100

Difficulty Level: Intermediate

Tools Required

- Computer with internet connection

- Brokerage Account online or traditional

Supplies & Materials

- Financial Documents for account setup

- Research Materials books, articles, or online courses on investing

Step-by-Step Instructions

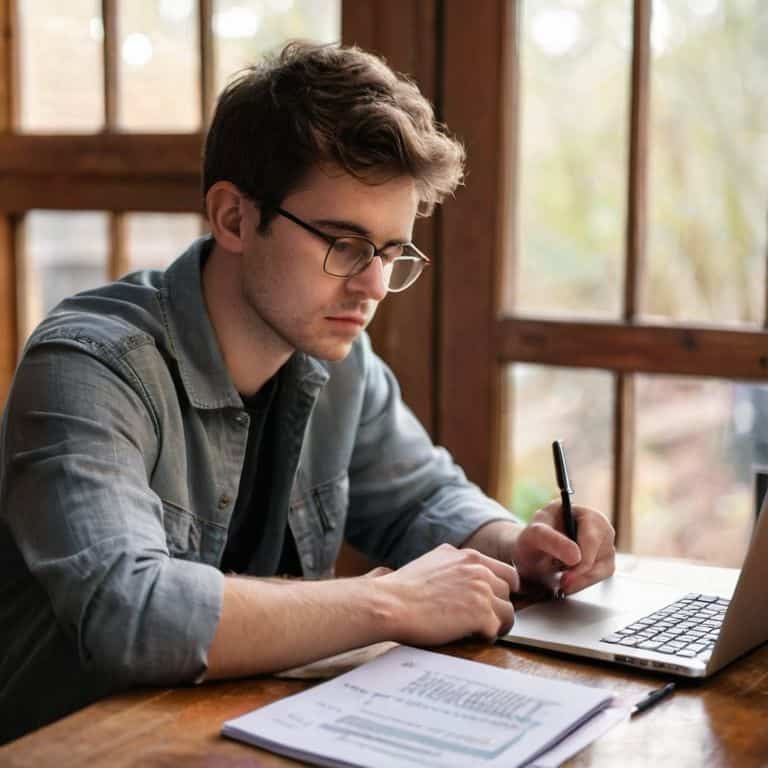

- 1. First, let’s start by setting clear financial goals. This means defining what you want to achieve through investing, whether it’s saving for a down payment on a house, retirement, or a big purchase. Take some time to reflect on what’s important to you and what you hope to gain from investing. Write down your goals and make them specific, measurable, and attainable.

- 2. Next, it’s essential to assess your current financial situation. This includes calculating your income, expenses, assets, and debts. You can use a budgeting app or spreadsheet to make this process easier. Understanding your financial situation will help you determine how much you can afford to invest each month and what kind of investments are suitable for you.

- 3. Now, let’s talk about understanding your risk tolerance. This refers to your ability to withstand market fluctuations and potential losses. If you’re new to investing, it’s crucial to be honest about your risk tolerance to avoid making investments that might keep you up at night. Consider factors like your age, income stability, and financial goals when evaluating your risk tolerance.

- 4. The fourth step is to choose an investment account. You have several options, including brokerage accounts, retirement accounts (like IRAs or 401(k)s), and robo-advisor accounts. Each type of account has its own set of rules, benefits, and limitations. Research each option carefully and select the one that best aligns with your financial goals and risk tolerance.

- 5. Once you’ve selected your investment account, it’s time to fund your account. You can do this by setting up a transfer from your checking account or by depositing a lump sum. Consider setting up a regular investment schedule to make investing a habit. This approach can help you take advantage of dollar-cost averaging, which can reduce the impact of market volatility on your investments.

- 6. Now that your account is funded, it’s time to select your investments. This can be overwhelming, especially for beginners. Start by considering diversified investment portfolios, which can help spread risk and increase potential returns. You can choose from a variety of assets, including stocks, bonds, ETFs, and mutual funds. If you’re not sure where to start, consider consulting with a financial advisor or using a robo-advisor that offers pre-built portfolios.

- 7. The seventh step is to monitor and adjust your portfolio over time. Investing is not a set-it-and-forget-it activity. Markets fluctuate, and your financial goals or risk tolerance may change. Regularly review your portfolio to ensure it remains aligned with your objectives. Rebalancing your portfolio as needed can help keep you on track and ensure that your investments continue to support your long-term goals.

- 8. Finally, stay informed but avoid emotional decisions. Investing can be volatile, and it’s essential to stay up-to-date with market news and trends. However, it’s equally important not to make investment decisions based on emotions, such as fear or greed. Instead, rely on your well-thought-out investment plan and the discipline to stick to it, even during turbulent times. This will help you navigate the ups and downs of the market and stay focused on your long-term financial goals.

A Guide to Starting to Invest

As you embark on your investment journey, it’s essential to understand that investing for beginners with little money can be just as effective as investing with a large sum. The key is to start small and be consistent. Long term investing has numerous benefits, including allowing your money to grow over time and riding out market fluctuations. By starting early, you can take advantage of compound interest and set yourself up for financial success.

When it comes to navigating the stock market, it’s crucial to grasp the concept of stock market volatility. This means being prepared for ups and downs in the market and avoiding making emotional decisions based on short-term fluctuations. Instead, focus on your long-term goals and remember that diversification in a portfolio is key to minimizing risk. By spreading your investments across different asset classes, you can reduce your exposure to any one particular market or sector.

As a new investor, it’s also important to be aware of common mistakes that can derail your progress. One of the most significant errors is failing to choose the right brokerage account for your needs. Take the time to research and compare different options, considering factors such as fees, investment options, and customer support. By doing your due diligence and setting yourself up for success, you can avoid costly mistakes and stay on track to achieving your financial goals.

Avoiding Common Mistakes in Stock Market Volatility

As a beginner, it’s essential to be aware of the common pitfalls that can derail your investment journey. One of the most significant challenges is navigating stock market volatility. To avoid common mistakes, start by understanding that market fluctuations are a natural part of the investing process. Avoid making emotional decisions based on short-term market movements, and instead, focus on your long-term goals.

I recommend creating a checklist to help you stay on track. This can include items like regularly reviewing your portfolio, rebalancing as needed, and avoiding the temptation to try to time the market. By following these simple steps and maintaining a clear head, you can minimize the impact of market volatility and stay focused on your investment objectives.

Investing for Beginners With Little Money

Investing for Beginners with Little Money

You don’t need a fortune to start investing. In fact, many investment apps and platforms allow you to begin with as little as $100 or even less. The key is to start small and be consistent. Consider setting aside a fixed amount each month, even if it’s just $10 or $20. Over time, this can add up and help you build a sizable investment portfolio.

I recommend exploring micro-investing apps that offer low or no fees, and allow you to invest small amounts of money into a diversified portfolio. This can be a great way to get started, even with limited funds.

5 Essential Tips to Kickstart Your Investment Journey

- Set clear financial goals and risk tolerance to guide your investment decisions

- Start small and be consistent, even with little money, to build the habit and learn as you go

- Understand the basics of diversification to minimize risk and maximize potential returns

- Automate your investments to make saving and investing a stress-free, routine process

- Continuously educate yourself on personal finance and investing to make informed decisions and avoid costly mistakes

Key Takeaways for a Successful Investment Journey

Start small and be consistent: even with little money, you can begin investing by setting aside a fixed amount regularly and leveraging low-cost index funds or ETFs

Educate yourself but avoid analysis paralysis: understand the basics of investing, including risk management and diversification, but don’t let fear of the unknown hold you back from taking your first steps

Develop a long-term perspective and discipline: investing is a marathon, not a sprint; by avoiding common mistakes like trying to time the market and staying informed but not emotional, you can navigate stock market volatility and work towards your financial goals

Investing with Clarity

The moment you turn your financial dreams into a structured plan is the moment you’ll realize that investing isn’t about being wealthy, it’s about being intentional with your wealth, no matter how small it may seem.

Rachel Evans

Conclusion: Turning Dreams into Reality

As we conclude this journey to starting your investment journey, let’s recap the key takeaways: we’ve covered the essential steps to begin investing, from understanding your financial situation to navigating the stock market. We’ve also explored how to invest with little money and avoid common mistakes in times of stock market volatility. By following these steps and maintaining a disciplined approach, you’ll be well on your way to building a strong financial foundation. Remember, investing is a long-term game, and it’s essential to stay informed, patient, and committed to your goals.

Now that you have a clear roadmap to investing, it’s time to take the first step. Don’t let fear or uncertainty hold you back from turning your financial dreams into reality. With persistence, the right mindset, and a well-structured plan, you can overcome any obstacle and achieve your investment goals. So, go ahead, take a deep breath, and start your investment journey today – you got this, and every step forward is a step closer to the financial future you deserve.

Frequently Asked Questions

What are the minimum investment amounts required to get started with investing?

To get started, you don’t need a fortune. Many brokerages now offer zero or low minimum balance requirements. You can begin with as little as $100 or even $10 in some cases, depending on the platform. I recommend checking out apps like Robinhood, Stash, or Acorns for beginner-friendly options with minimal investment requirements.

How do I choose the right brokerage account for my investment goals?

Let’s break it down: to choose the right brokerage account, consider your investment goals, risk tolerance, and fees. Ask yourself: What are my investment objectives? Do I need automated trading or research tools? What are the maintenance and trading fees? Make a checklist of your needs and compare brokerage accounts to find the best fit for you.

What are some common investment terms I should understand before beginning my investment journey?

Let’s break it down: before investing, it’s essential to understand key terms like diversification, portfolio, and risk tolerance. Don’t worry, I’ve got you covered – I’ll explain each in simple terms, so you can confidently start your investment journey. Think of it as building a strong foundation, one step at a time.