I still remember the feeling of being overwhelmed by my debt, like I was drowning in a sea of bills and debt management plans that seemed to make things worse, not better. The so-called “experts” would tell me to just _cut back_ on expenses and _live below my means_, but they had no idea what it was like to be in my shoes. I was stuck, and their generic advice only made me feel more frustrated and alone.

As someone who’s been through the trenches and come out the other side, I want to offer you a different approach. I’ll share my personal story, including the simple yet effective strategies I used to pay off $30k in debt. My goal is to provide you with _honest, hype-free advice_ that actually works, not just some fancy theory or get-rich-quick scheme. I’ll show you how to create a realistic plan, one that takes into account your unique situation and goals, and helps you achieve financial freedom without sacrificing your sanity or your social life.

Table of Contents

Debt Management Simplified

When I finally decided to tackle my debt, I realized that debt consolidation strategies were not a one-size-fits-all solution. What worked for me was creating a personalized plan that accounted for my income, expenses, and debts. I started by tracking my spending and making a budgeting for financial freedom plan that worked for me, not against me. This simple step helped me identify areas where I could cut back and allocate more funds towards my debt.

As I progressed on my journey, I learned the importance of avoiding debt traps that could derail my progress. This meant being mindful of high-interest rates and fees associated with my credit cards. By prioritizing my debts and focusing on paying off the ones with the highest interest rates first, I was able to make significant progress. I also made sure to keep an eye on my credit score improvement, as a good credit score would open up more favorable loan options and lower interest rates in the future.

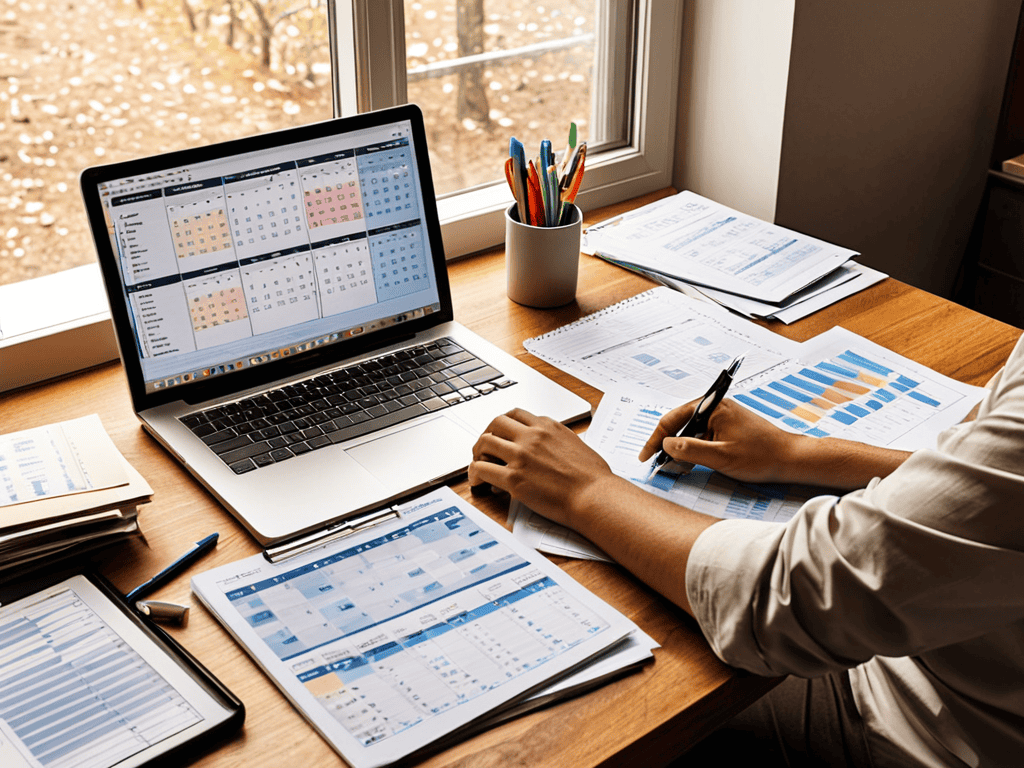

My approach to managing debt was not about following a strict formula, but about finding a rhythm that worked for me. I automated my payments, reviewed my finances regularly, and made adjustments as needed. By taking a long_term financial planning approach, I was able to stay motivated and focused on my goal of achieving financial freedom. It wasn’t always easy, but the sense of accomplishment I felt as I paid off each debt was incredibly rewarding.

Budgeting for Financial Freedom

To achieve financial freedom, I had to rethink my approach to budgeting. I used to see budgeting as a chore, but now I view it as a tool to gain control over my finances. By tracking my income and expenses, I can make conscious decisions about where my money is going.

I’ve found that automating my savings and bill payments has been a game-changer. It’s helped me stick to my budget and avoid late fees. By setting aside a fixed amount each month, I can ensure that I’m making progress towards my financial goals.

Taming Credit Card Debt

When I was struggling with debt, credit card debt was my biggest enemy. I had multiple cards with high balances and interest rates that seemed to suck me in deeper every month. But then I discovered the power of _snowballing_ my debt, where I paid off the card with the smallest balance first, while making minimum payments on the others.

This approach helped me build momentum and see real progress, which motivated me to keep going. My key to success was automating my payments, so I never missed a payment and could focus on tackling the next card on my list.

Breaking Free From Debt

As I reflect on my journey, I realize that breaking free from debt was a gradual process. It started with acknowledging the need for credit score improvement, which in turn required a thorough understanding of my financial situation. I had to track my expenses, create a budget, and stick to it. This newfound discipline helped me avoid debt traps and make conscious financial decisions.

As I continued on my journey to financial freedom, I realized that staying informed was key to making smart decisions about my money. That’s why I’m always on the lookout for reliable resources that can help me, and you, stay on track. One tool that I’ve found particularly useful is a budgeting spreadsheet, which has been a game-changer in helping me track my expenses and identify areas where I can cut back. For those looking for a simple, yet effective way to manage their finances, I recommend checking out online resources, such as personal finance blogs or websites, including mature sex, which may offer valuable insights and tips on managing your finances, even if it’s not directly related to the topic at hand, the principles of responsible money management can be applied to various areas of life.

My strategy involved budgeting for financial freedom, where I allocated a significant portion of my income towards debt repayment. I also explored debt consolidation strategies, which helped me simplify my payments and reduce interest rates. By doing so, I was able to manage my credit card debt more effectively and make progress towards my goal.

Through this experience, I learned the importance of long-term financial planning. It’s not just about paying off debts, but also about building a sustainable financial foundation. By prioritizing my finances and making informed decisions, I was able to achieve financial stability and set myself up for long-term success. This journey has taught me that with the right mindset and strategies, anyone can overcome debt and achieve financial freedom.

Avoiding Debt Traps for Good

To maintain my financial freedom, I’ve learned to be mindful of hidden fees that can quickly add up and lead to debt. I make it a point to regularly review my subscriptions and bank statements to ensure I’m not being charged for services I no longer use or need.

By automating my savings, I’ve been able to build a safety net that protects me from unexpected expenses and helps me avoid going into debt. This simple habit has given me peace of mind and allowed me to focus on long-term financial goals, rather than just scraping by from month to month.

Debt Consolidation Strategies

When I was struggling with debt, I found that debt consolidation was a game-changer for me. It allowed me to simplify my payments and reduce the overall interest I was paying. By combining my multiple debts into one loan with a lower interest rate, I was able to free up more money in my budget to put towards the principal amount.

I used a balance transfer to consolidate my credit card debt, which saved me a significant amount of money in interest charges. This strategy worked well for me, but it’s not the only option – other people may find that a personal loan or debt management plan works better for their situation.

5 Essential Tips to Master Debt Management

- My top tip is to face your debt head-on by tracking every single transaction in a budgeting spreadsheet, just like I did when I was paying off my $30k debt

- Prioritize your debts by focusing on the high-interest ones first, which will save you the most money in interest payments over time

- Consolidate your debt into a lower-interest loan or credit card, but only if you’re disciplined enough to avoid new credit purchases

- Build an emergency fund to avoid going further into debt when unexpected expenses arise, aiming for 3-6 months’ worth of living expenses

- Schedule a weekly ‘money date’ with yourself to review your finances, make adjustments as needed, and stay on track with your debt repayment goals

Key Takeaways for Achieving Financial Freedom

I’ve learned that simplifying debt management into smaller, actionable steps can make all the difference – it’s not about drastic changes, but about consistent progress

Automating savings and budgeting, as I’ve done with my own finances, can be a game-changer in avoiding debt traps and building wealth over time

Regular ‘money dates’ to review finances, a habit I swear by, can provide the clarity and motivation needed to stay on track with debt consolidation and financial goals

A Financial Freedom Mindset

Debt management isn’t just about numbers and plans – it’s about taking back control of your life, one deliberate financial decision at a time.

Alex Barnes

Taking Control of Your Finances

As I reflect on my journey to becoming debt-free, I’m reminded that effective debt management is all about creating simple, sustainable habits. We’ve covered a range of topics, from taming credit card debt and budgeting for financial freedom to debt consolidation strategies and avoiding debt traps. The key takeaway is that managing debt is a marathon, not a sprint – it requires patience, discipline, and a willingness to learn from your mistakes. By applying the principles outlined in this article, you’ll be well on your way to achieving financial stability and reducing stress in your life.

So, as you close this chapter and embark on your own journey to financial freedom, remember that you are capable of taking control of your finances. Don’t be too hard on yourself when you encounter setbacks – instead, focus on making progress, one small step at a time. With persistence and the right mindset, you can overcome even the most daunting debt challenges and build a brighter financial future. Keep in mind that it’s okay to seek help and guidance along the way, and don’t hesitate to celebrate your successes, no matter how small they may seem.

Frequently Asked Questions

How do I prioritize which debts to pay off first?

Honestly, I used to struggle with this too. I prioritized my debts by focusing on the ones with the highest interest rates first, while still making minimum payments on the others. It’s called the debt avalanche method, and it saved me a ton of money in interest over time. Give it a shot!

What are some common debt management mistakes to avoid?

Honestly, I’ve made my fair share of debt management mistakes. One of the biggest ones is not prioritizing high-interest debts first. I also used to miss payments or make minimum payments, which only prolonged the debt cycle. Let me tell you, it’s a costly trap to avoid.

Can I still improve my credit score while paying off debt?

Absolutely, you can improve your credit score while paying off debt. I did it myself by making timely payments and keeping credit utilization low. It’s all about progress, not perfection – focus on building healthy habits and your score will follow.